An Educational Role on Harmonizing Regulatory Frameworks for Investigating Tax Crime Suspects and Applying Coercive Measures During the Preliminary Evidence Stage

https://doi.org/10.54012/jcell.v5i001.640

https://doi.org/10.54012/jcell.v5i001.640

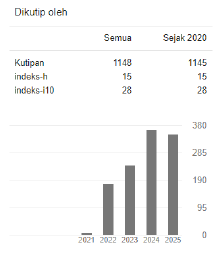

Abstract views: 77

Abstract views: 77

PDF downloads: 56

PDF downloads: 56

Keywords:

Educational Role, Preliminary Evidence, Tax Crime, Coercive MeasuresAbstract

Law enforcement in Indonesia’s tax system often involves coercive actions such as searches and seizures. Regulation No. 177/PMK.03/2022 of the Minister of Finance is the latest directive governing procedures for conducting preliminary evidence examinations in tax crime cases. Articles 8 and 17 stipulate that coercive measures may be undertaken prior to a formal investigation. This study adopts a normative juridical method, using both the statutory and conceptual approaches to analyze legal materials and clarify the meanings embedded in legal terminology. From an educational standpoint, this research highlights the importance of increasing legal literacy and understanding among tax officials, investigators, and taxpayers regarding the lawful use of coercive measures.

The analysis of Articles 8 and 17 of Regulation No. 177/PMK.03/2022 reveals that these provisions provide a legal basis for authorities to apply coercive measures during preliminary evidence inquiries into alleged tax offenses. However, inconsistencies remain between these provisions and the principles outlined in Indonesia’s Criminal Procedure Code (KUHAP). Therefore, legislative reform is strongly recommended to harmonize the relevant laws. Educational initiatives play a key role in this harmonization process by fostering awareness of legal limits, promoting fairness, and ensuring that coercive measures are exercised in accordance with procedural justice and human rights principles. Revising Regulation No. 177/PMK.03/2022 to align it more closely with KUHAP would not only enhance legal certainty but also serve as a valuable learning framework for both practitioners and students of tax law.

Downloads

References

Bentham, J. (1843). The Works of Jeremy Bentham (J. Bowring, Ed., Vol. 1). Edinburgh: William Tait.

Bryman, A. (2016). Social Research Methods (5th ed.). Oxford: Oxford University Press.

Diantha, I. M. P. (2016). Metodologi Penelitian Hukum Normatif dalam Justifikasi Teori Hukum. Jakarta: Prenada Media Group.

Febrianti, A., Nugroho, R., & Sari, D. (2025). Legal Certainty and Human Rights in Indonesian Criminal Procedure: A Contemporary Analysis. Journal of Legal Studies and Policy, 12(2), 45–60.

Friedman, L. M. (2011). The Legal System: A Social Science Perspective. New York: Russell Sage Foundation.

Hyronimus, R. (2011). Filsafat Hukum. Yogyakarta: Universitas Atma Jaya Yogyakarta.

Marzuki, P. M. (2017). Penelitian Hukum. Jakarta: Kencana Prenada Media Group.

Mertens, D. M. (2019). Research and Evaluation in Education and Psychology: Integrating Diversity with Quantitative, Qualitative, and Mixed Methods (5th ed.). Thousand Oaks, CA: SAGE Publications.

OECD. (2022). Fighting Tax Crime: The Ten Global Principles (Second Edition). Paris: OECD Publishing. https://doi.org/10.1787/10.1787/0fd007a9-en

Simanjuntak, N. (2019). Coercive Measures in Criminal Investigation: A Legal and Human Rights Perspective. Indonesian Journal of Law and Society, 3(1), 78–95.

Soekanto, S., & Mamudji, S. (2015). Penelitian Hukum Normatif: Suatu Tinjauan Singkat. Jakarta: RajaGrafindo Persada.

Sulaiman, A. (2020). The Role of Legal Education in Promoting Human Rights and Justice in Indonesia. Indonesian Journal of Legal Reform, 8(3), 112–129.

Tamanaha, B. Z. (2017). A Realistic Theory of Law. Cambridge: Cambridge University Press.

United Nations. (1948). Universal Declaration of Human Rights. Paris: United Nations General Assembly.

UNODC. (2021). Manual on Countering Tax Crimes and Other Related Crimes. Vienna: United Nations Office on Drugs and Crime.

Zulfa, E. A. (2021). Keadilan dan Kepastian Hukum dalam Sistem Peradilan Pidana di Indonesia. Bandung: Refika Aditama.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Eko Dodi Supriatna, Rahel Octora

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All articles published in the Journal Corner of Education, Linguistics, and Literature are licensed under the Creative Commons Attribution-ShareAlike License (CC BY-SA).