Islamic Investment and Capital Market: Analysis of Developments and Challenges in the Modern Era

https://doi.org/10.54012/jcell.v5i001.586

https://doi.org/10.54012/jcell.v5i001.586

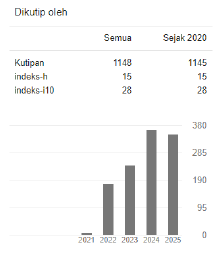

Abstract views: 256

Abstract views: 256

PDF downloads: 665

PDF downloads: 665

Keywords:

Sharia Capital Market, Halal Investment, Sharia Principles, Islamic Economics, Sharia StocksAbstract

The Islamic capital market has experienced significant growth in recent decades as an investment alternative compliant with Islamic principles. This development demonstrates that the Islamic financial system is not only an option for Muslims but is also beginning to attract the attention of global investors seeking more ethical and sustainable investment instruments. This article comprehensively analyzes the development of Islamic investment and capital markets, identifying their underlying principles and evaluating the challenges and opportunities faced in the context of the modern global economy. Using a descriptive-analytical approach, this study demonstrates that the Islamic capital market not only provides a halal investment alternative for Muslims but also offers stability and sustainability that can attract investors from diverse backgrounds. The unique characteristics of the Islamic capital market, which avoids riba (usury), gharar (gharar), and maysir (risk of gambling), create a strong foundation for more stable and sustainable long-term investment. These principles not only ensure compliance with Islamic teachings but also encourage more transparent and responsible business practices However, challenges such as global standardization, investor literacy, and product innovation still need to be addressed to maximize the potential of the Islamic capital market. Global standardization is crucial given that differences in sharia interpretations across countries can hinder cross-border market growth. Furthermore, the low level of investor literacy regarding sharia products requires ongoing educational efforts. Product innovation is also necessary to meet the increasingly diverse and dynamic needs of investors. By addressing these challenges, the Sharia capital market has significant potential to continue growing and make a significant contribution to the stability of the global financial system.

Downloads

References

Afifi, Z. K. (2024). Financial Sukuk: Concept, Legal Principles, and Types. Asian Journal of Economics, Business and Accounting, 24(2), 98–106. https://doi.org/10.9734/ajeba/2024/v24i21224

Alnamlah, A., Hassan, M. K., Alhomaidi, A., & Smolo, E. (2022). A new model for screening Shariah-compliant firms. Borsa Istanbul Review, 22, S10–S23. https://doi.org/10.1016/j.bir.2022.10.011

Bahari, L. A., & Zaman, K. (2023). Syukur dalam Perspektif Al-Qur’an Setudi komparasi tafsir ibn katsir dan Tafsir Al Ibriz. Jurnal Ilmu Al-Qur’an, Tafsir Dan Pemikiran Islam, 4(2), 293–308.

Choiri, A., & Mustofa, M. W. (2024). Perkembangan Pasar Modal Syariah ( Saham Syariah , Sukuk , Reksadana Syariah ) Dan Pengaruhnya Terhadap. Jurnal Keuangan Dan Manajemen Terapan, 5(4), 321.

Ista, A., Marunta, R. A., Taqiyuddin, A. M., Yakub, & Ista, N. A. (2024). Riba, Gharar, Dan Maysir dalam Sistem Ekonomi Akram. Jurnal Tana Mana, 4(3), 315–330.

JAMILAH, J., & BASYARUDIN, B. (2023). Konsep Dan Prinsip Pasar Modal Konvensional Versus Pasar Modal Syariah. Jurnal Ilmiah Hukum Dan Keadilan, 10(1), 115–122. https://doi.org/10.59635/jihk.v10i1.273

Joudar, F., Msatfa, Z., Metwalli, O., Mouabid, M., & Dinar, B. (2023). Islamic Financial Stability Factors: An Econometric Evidence. Economies, 11(3), 1–13. https://doi.org/10.3390/economies11030079

Karamillah, A. (2022). Syariah Capital Market Instruments : Structures , Compliance , and Market Relevance. 3(2), 100–110.

Khoiruddin, & Syahpawi. (2024). Industri Pasar Modal Syariah di Malaysia dan Indonesia. Madani: Jurnal Ilmiah Multidisiplin, 2(4), 91–95.

Kholisatun, N., Ratna Pratiwi, F., & Nurhakim, M. (2024). Aisyiyah Dan Pemberdayaan Perempuan Dalam Upaya Kesetaraan Gender. Jurnal Ilmu Pendidikan Islam, 2(3), 306–319.

Lailatul Qomariyyah, Febbi Dian Amalia Sari, & GHIFARI ROBBY MAULANA. (2024). Efektifkah Fintech terhadap perkembangan pasar modal syariah? JIEF Journal of Islamic Economics and Finance, 4(2), 1–11. https://doi.org/10.28918/jief.v4i2.8657

Lestari, A., & Kurniawati, F. (2023). Implementasi Prinsip-Prinsip Syariah Dalam Berinvestasi Di Pasar Modal Indonesia. Jurnal Sahmiyya, 2(2), 521–522.

Md. Hashim, A., Habib, F., Isaacs, Z., & Gadhoum, M. A. (2017). ISRA-Bloomberg Sharīʿah stock screening and income cleansing methodologies: a conceptual paper. ISRA International Journal of Islamic Finance, 9(1), 27–42. https://doi.org/10.1108/IJIF-07-2017-004

Melisa, Seri Wahhyuni, Trisna Eka Sari, Z. H. (2024). Investasi Berkelanjutan dalam Perspektif Ekonomi Syariah. MUSYTARI, Neraca Manajemen, Ekonomi, 5(1), 1.

Noor Iffatin Nadhifah, & Siti Imaniatul Muflihatin. (2024). Obligasi Syari’ah : Antara Teori dan Implikasi. Jurnal Publikasi Manajemen Informatika, 3(2), 01–05. https://doi.org/10.55606/jupumi.v3i2.3675

Sabila, F. H., Adiguna, P., & Indonesia, M. (2024). Menanggapi Perbedaan Kriteria Sharia Stock Screening. Liabilities (Jurnal Pendidikan Akuntansi), 7, 24–34. https://doi.org/10.30596/liabilities.v7i2.20793

Saidatolakma Mohd Yunus, Sayed Sikandar al-Haneef Zuraidah Kamaruddin, & Mek Wok Mahmud. (2017). Purification of non-halal income in Malaysian Islamic banks: An overview. Journal of Islam in Asia, 14(2), 305–326. http://journals.iium.edu.my/jiasia/index.php/Islam/article/view/616

Sakinah, G., Kasri, R. A., & Nurkholis, N. (2022). Islamic Finance and Indonesia’s Economy: An Empirical Analysis. Jurnal Ekonomi & Keuangan Islam, 8(1), 47–59. https://doi.org/10.20885/jeki.vol8.iss1.art4

Sari, M., Purnomo, H. D., & Sembiring, I. (2022). Review : Algoritma Kriptografi Sistem Keamanan SMS di Android. Journal of Information Technology, 2(1), 11–15. https://doi.org/10.46229/jifotech.v2i1.292

Sukawati, Ali, M. fikr., & Mujtaba, M. H. (2023). Analisis Perinsip Keadilan dalam Transaksi Bisnis dan Investasi syariah. Education Journal, 2(1), 24–29.

Toha, M., Manaku, A. C., & Zamroni, M. A. (2020). Perkembangan Dan Problematika Pasar Modal Syariah Di Indonesia. Al-Tsaman : Jurnal Ekonomi Dan Keuangan Islam, 2(1), 135–144.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Intan Amelia Damayanti

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All articles published in the Journal Corner of Education, Linguistics, and Literature are licensed under the Creative Commons Attribution-ShareAlike License (CC BY-SA).