The Effect of Financial Performance, Environmental Performance, and Carbon Emission Disclosure on Firm Value: A Cognitive Learning Preferences Perspective

https://doi.org/10.54012/jcell.v5i001.564

https://doi.org/10.54012/jcell.v5i001.564

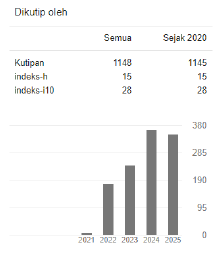

Abstract views: 178

Abstract views: 178

PDF downloads: 288

PDF downloads: 288

Keywords:

Financial Performance, Environmental Performance, Carbon Emission Disclosure, Firm Value, Cognitive Learning PreferencesAbstract

This study examined the effect of financial performance, environmental performance, and carbon emission disclosure on firm value. The research population consists of energy and basic materials sector companies listed on the Indonesian Stock Exchange (IDX) during the period 2021–2023, with a final sample of 33 companies. Data were obtained from financial reports, sustainability reports accessed via IDX and company websites, as well as PROPER KLHK documentation. The study employs a quantitative approach with panel data regression analysis. The findings reveal that financial performance has a significant positive effect on firm value, whereas environmental performance and carbon emission disclosure do not demonstrate significant effects. Beyond its empirical contribution, this study also offers implications for business education, particularly in aligning sustainability and financial analysis with cognitive learning preferences. By integrating these findings into diverse instructional modalities, educators can foster a deeper understanding of the interplay between financial performance, environmental responsibility, and corporate value among future professionals.

Downloads

References

Azis, M. T., Sari, I., & Djajuli, M. (2023). The effect of ESG disclosure on financial performance: Evidence from Indonesia. International Journal of Economics and Finance Studies, 15(1), 55–66.

Azis, N., & Mawardi, A. (2023). Digital transformation and ESG: Empirical study in Indonesian SOEs. Indonesian Journal of Sustainability Accounting and Management, 7(1), 32–45.

Clark, T., Epstein, A. L., & Michael, D. (2020). Sustainability disclosures and financial outcomes: Evidence from Asia. Asian Journal of Sustainability and Social Responsibility, 5(1), 1–18.

De Klerk, M. L., & de Villiers, S. (2012). The influence of corporate social responsibility disclosure on share prices. Pacific Accounting Review, 24(1), 18–40.

Eccles, G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Management Science, 60(11), 2835–2857.

Eccles, R. G., & Krzus, L. (2010). One report: Integrated reporting for a sustainable strategy. Hoboken, NJ: Wiley.

Elkington, J. (1997). Cannibals with forks: The triple bottom line of 21st century business. Oxford, UK: Capstone Publishing.

Fatemi, A., & Fooladi, Z. (2018). Sustainable finance: A new paradigm. Global Finance Journal, 38, 1–12.

Freeman, E. A. (1984). Strategic management: A stakeholder approach. Boston, MA: Pitman.

Freeman, R. E. (2001). Managing for stakeholders. Ethical Theory and Business, 7(1), 39–53.

Friede, B., Busch, T., & Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210–233.

García-Sánchez, A. M., & García-Sánchez, J. F. (2020). Does critical mass of female directors influence corporate sustainability disclosure? Corporate Social Responsibility and Environmental Management, 27(3), 1242–1253.

Ioannou, I., & Serafeim, G. (2012). What drives corporate social performance? The role of nation-level institutions. Journal of International Business Studies, 43(9), 834–864.

Jensen, M. C. (2002). Value maximization, stakeholder theory, and the corporate objective function. Business Ethics Quarterly, 12(2), 235–256.

Khan, M. A., Serafeim, M., & Yoon, A. (2016). Corporate sustainability: First evidence on materiality. The Accounting Review, 91(6), 1697–1724.

Laskar, A., & Maji, R. (2016). Disclosure of corporate sustainability performance and firm performance in Asia. Asian Review of Accounting, 24(4), 460–475.

Liu, L. Y., Gup, L. A., & Bell, R. M. (2016). Sustainability and firm value: An analysis of the banking industry. Journal of Banking & Finance, 65, 1–14.

Marti, K. J., & Scherer, J. (2020). Analyzing ESG strategies: Stakeholder theory in action. Business Strategy and the Environment, 29(6), 2570–2582.

Qiu, Y., Shaukat, A., & Tharyan, Y. (2016). Environmental and social disclosures: Link with corporate financial performance. British Accounting Review, 48(1), 102–116.

Rowe, S. T., & Rogers, D. C. (2022). The relationship between ESG disclosure and firm value. Journal of Applied Corporate Finance, 34(1), 35–43.

Serafeim, G. (2020). Public sentiment and the price of corporate sustainability. Financial Analysts Journal, 76(2), 26–46.

Sultana, M. A. (2021). ESG disclosure and its impact on financial performance: Evidence from developing countries. Emerging Markets Review, 47, 100726.

Whelan, K. (2020). ESG ratings and performance of sustainable investment funds. European Business Review, 30(1), 93–109.

Widyastuti, D. H., & Agustia, S. (2020). Corporate governance, ESG disclosure, and firm value. Journal of Accounting and Investment, 21(3), 409–423.

Yadav, S., Hanief, A., & Pathak, S. (2021). ESG and firm performance: Evidence from emerging markets. Journal of Cleaner Production, 314, 128013.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Intan Sari, Mohammad Taufik Azis, Mohamad Djajuli

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All articles published in the Journal Corner of Education, Linguistics, and Literature are licensed under the Creative Commons Attribution-ShareAlike License (CC BY-SA).