The Effect of Sustainability Report Disclosure on Stock Prices: An Educational Review

https://doi.org/10.54012/jcell.v5i001.561

https://doi.org/10.54012/jcell.v5i001.561

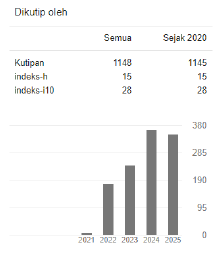

Abstract views: 349

Abstract views: 349

PDF downloads: 389

PDF downloads: 389

Keywords:

Sustainability Reporting, Economic Performance;, Social Performance, Environmental Disclosure, Mining Sector, Corporate TransparencyAbstract

This study aimed to examine the effect of sustainability performance disclosure on stock prices in mining sector companies listed on the Indonesia Stock Exchange. The disclosure is assessed through three dimensions: economic, social, and environmental performance, based on the Global Reporting Initiative (GRI) standards. Using multiple linear regression analysis with secondary data from sustainability reports and stock price data, the study evaluates both partial and simultaneous effects of the independent variables. The results show that environmental performance disclosure has a significant negative influence on stock prices, social performance has a weak and marginally significant effect, while economic performance disclosure has no significant impact. However, the overall model is statistically significant, indicating that the combined disclosure of the three dimensions has a strong influence on stock price movements. The coefficient of determination (R²) indicates that 95.85% of stock price variation is explained by the model, highlighting a high explanatory power. From an educational review perspective, the findings emphasize the importance of integrating sustainability reporting into business and financial education curricula. By understanding how environmental, social, and economic disclosures affect investor perceptions and market behavior, students, policymakers, and corporate stakeholders can gain deeper insights into the practical relevance of sustainability in capital markets. This educational lens highlights the need for future leaders to balance short-term financial performance with long-term sustainability goals. The study therefore recommends that companies enhance the quality and transparency of sustainability reporting, especially in environmental aspects, to better align with long-term investor expectations and strategic corporate value creation.

Downloads

References

Belkaoui, A., & Karpik, P. (2020). Determinants of the corporate decision to disclose social information. Accounting, Auditing & Accountability Journal, 1(2), 36–51.

Clarkson, D., Li, Y., Richardson, G., & Vasvari, F. (2021). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4–5), 303–327.

Elkington, M. (1999). Cannibals with forks: The triple bottom line of 21st century business. Oxford: Capstone.

Financial Services Authority (OJK). (2017). Regulation No. 51/POJK.03/2017 on the implementation of sustainable finance. Jakarta: OJK.

Fombrun, E. F., & Van Riel, C. (2004). Fame and fortune: How successful companies build winning reputations. New Jersey: Prentice Hall.

Freeman, M., & Reed, D. (2022). Environmental disclosures and firm market value: Evidence from sustainability reports. Journal of Financial Economics, 108(3), 635–655.

Global Reporting Initiative (GRI). (2021). Global Reporting Initiative Standards. https://www.globalreporting.org/

Gray, R., Owen, D., & Adams, C. (2001). Accounting and accountability: Changes and challenges in corporate social and environmental reporting. London: Prentice Hall.

Guthrie, J., & Parker, L. (2022). Corporate social reporting: A rebuttal of legitimacy theory. Accounting and Business Research, 19(76), 343–352.

Hackston, A., & Milne, M. (2022). Some determinants of social and environmental disclosures in New Zealand companies. Accounting, Auditing & Accountability Journal, 9(1), 77–108.

Haniffa, I., & Cooke, T. (2020). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391–430.

Hadi, A., Setiawan, M., & Sari, Y. (2021). Sustainability report disclosure and its impact on firm value: Evidence from Indonesia. Indonesian Journal of Sustainability Accounting and Management, 4(2), 79–92.

Hermawan, H., & Mulyadi, L. A. (2022). Environmental disclosure and financial performance of mining companies in Indonesia. Asian Journal of Business and Accounting, 11(1), 87–110.

Islam, S., & Deegan, C. (2021). Media pressures and corporate disclosure of social responsibility performance information: A study of two global clothing and sports retail companies. Accounting and Business Research, 40(2), 131–148.

Kuo, R., & Chen, Y. (2023). ESG performance and stock market reactions: Evidence from Asia-Pacific mining firms. Asian Journal of Sustainability and Social Responsibility, 7(1), 15–31.

Mulyani, A., & Anwar, T. (2021). Pengaruh pengungkapan keberlanjutan terhadap nilai perusahaan dengan profitabilitas sebagai variabel moderasi. Jurnal Ilmu dan Riset Akuntansi, 9(3), 1–18.

Puspitasari, T., & Rachman, R. (2023). Sustainability report disclosure and its effect on firm value: A study on mining companies. Jurnal Akuntansi, 18(2), 123–138.

Reverte, L. (2020). Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of Business Ethics, 88(2), 351–366.

Saka, C., & Oshika, J. (2021). Disclosure effects, carbon emissions and corporate value: Evidence from Japan. Sustainability Accounting, Management and Policy Journal, 5(1), 22–45.

Sutrisno, M., & Nuraeni, S. (2023). Sustainability report dan pengaruhnya terhadap harga saham perusahaan tambang. Jurnal Akuntansi Multiparadigma, 12(1), 35–48.

Tilt, R. (2022). The influence of external pressure groups on corporate social disclosure: Some empirical evidence. Accounting, Auditing & Accountability Journal, 9(1), 47–72.

United Nations. (2015). Transforming our world: The 2030 agenda for sustainable development. New York: United Nations.

Wahyuni, M., & Sudibyo, H. (2023). Corporate governance, sustainability disclosure, and firm value: Empirical evidence from Indonesia. Jurnal Dinamika Akuntansi dan Bisnis, 10(1), 55–72.

Wijayanti, F. (2021). Environmental performance disclosure and stock price: Evidence from Indonesia. Jurnal Keuangan dan Perbankan, 25(4), 707–720.

Winantisan, A. S., Putri, R., & Yusuf, M. (2024). The effect of sustainability disclosure on company value: Evidence from the mining sector in Indonesia. Jurnal Akuntansi dan Keuangan, 26(1), 45–56.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Putri Maulidya, Mohammad Taufik Azis, Mohamad Djajuli

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All articles published in the Journal Corner of Education, Linguistics, and Literature are licensed under the Creative Commons Attribution-ShareAlike License (CC BY-SA).