Evaluating the Use of QRIS in MSME Services: Insights for Financial Education in Tawang, Tasikmalaya

https://doi.org/10.54012/jcell.v4i001.405

https://doi.org/10.54012/jcell.v4i001.405

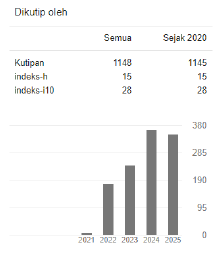

Abstract views: 266

Abstract views: 266

PDF downloads: 209

PDF downloads: 209

Keywords:

Technology, QRIS, Tawang, Tasikmalaya, MSMEs, Financial EducationAbstract

This study examines the use of Quick Response Code Indonesian Standard (QRIS) in Micro, Small, and Medium Enterprises (MSMEs) in Tawang District, Tasikmalaya, focusing on its impact on transaction efficiency and service quality. QRIS, a digital payment system introduced by Bank Indonesia, enables cashless, contactless payments through smartphones, thus offering a solution to slow cash transactions and improving operational efficiency. The research aims to explore how QRIS adoption enhances MSME competitiveness by increasing market reach, reducing operational costs, and improving customer service, particularly in post-pandemic Indonesia. Data collected through interviews, observations, and documentation from MSME owners in the district reveal that businesses such as Rumah Papi Bakery, Warteg Kahrisma Bahari, Bosqu Barber, and Azka Laundry have benefited from QRIS in terms of transaction speed, customer satisfaction, and financial management. The study also addresses the challenges of QRIS adoption, such as the need for a stable internet connection and public understanding of the system.

Downloads

References

Annida. (2024). Dampak Penggunaan Qris Terhadap Kepuasan Pengunjung Pada Museum Seni Rupa Dan Keramik Jakarta. 3(April), 304–313.

Arikunto. (2021). Pengantar Metodologi Penelitian. In Antasari Press.

Burns, P. (2022). Entrepreneurship and small business. Bloomsbury Publishing.

Dahlman, E., Parkvall, S., & Skold, J. (2020). 5G NR: The next generation wireless access technology. Academic Press.

Davies, R.; Harty, C. Measurement and exploration of individual beliefs about the consequences of building information modelling use. Constr. Manag. Econ. 2013, 31, 1110–1127

Fahrudin, F., & Isnaini, P. L. (2023). Pengaruh Penggunaan Quick Response Code Indonesian Standard (QRIS) Oleh UMKM Terhadap Pendapatan Usaha. Jurnal Manajemen Stratejik Dan Simulasi Bisnis, 4(1), 1–11. https://doi.org/10.25077/mssb.4.1.1-12.2023

Feyen, E., Natarajan, H., & Saal, M. (2023). Fintech and the Future of Finance: Market and Policy Implications. In Fintech and the Future of Finance: Market and Policy Implications. https://doi.org/10.1596/978-1-4648-1914-8

Foster, S. T., & Gardner, J. W. (2022). Managing quality: Integrating the supply chain. John Wiley & Sons.

Foster, B.; Hurriyati, R.; Johansyah, M.D. The Effect of Product Knowledge, Perceived Benefits, and Perceptions of Risk on Indonesian Student Decisions to Use E-Wallets for Warunk Upnormal. Sustainability 2022, 14, 6475. https://doi.org/10.3390/su14116475.

Haas, H., Islim, M. S., Chen, C., & Abumarshoud, H. (2021). An introduction to optical wireless mobile communication. Artech House.

Hussain, S.; Song, X.; Niu, B. Consumers’ Motivational Involvement in eWOM for Information Adoption: The Mediating Role of Organizational Motives. Front. Psychol. 2020, 10, 3055.

Hutagalung, R. A., Nainggolan, P., & Panjaitan, P. D. (2021). Analisis Perbandingan Keberhasilan UMKM Sebelum Dan Saat Menggunakan Quick Response Indonesia Standard (QRIS) Di Kota Pematangsiantar. Jurnal Ekuilnomi, 3(2), 94–103. https://doi.org/10.36985/ekuilnomi.v3i2.260

Kim, Y.J.; Han, J. Why smartphone advertising attracts customers: A model of web advertising, flow, and personalization. Comput. Hum. Behav. 2014, 33, 256–269.

Mall, P. I., & Mall, P. I. (2023). Efficiency of the Use of QRIS on Increasing Sales at Le Garden Palembang Indah Mall. 11(1), 54–62.

Malik, A.N.A.; Annuar, S.N.S. The Effect of Perceived Usefulness, Perceived Ease of Use, Reward, and Perceived Risk toward E-Wallet Usage Intention. In Eurasian Business and Economics Perspectives; Springer: Berlin/Heidelberg, Germany, 2021; pp. 115–130.

Muniarty, P., Dwiriansyah, M. S., Wulandari, W., Rimawan, M., & Ovriyadin, O. (2023). Efektivitas Penggunaan QRIS Sebagai Alat Transaksi Digital Di Kota Bima. Owner, 7(3), 2731–2739. https://doi.org/10.33395/owner.v7i3.1766

Pacey, A., & Bray, F. (2021). Technology in World Civilization, revised and expanded edition: A Thousand-Year History (Issue November). MIT Press.

Priyono, A. Analysis of the influence of trust and risk in the acceptance of Go-Pay electronic wallet technology. J. Bus. Strategy 2017, 21, 88–106.

Sholihah, E., & Nurhapsari, R. (2023). Percepatan Implementasi Digital Payment Pada UMKM: Intensi Pengguna QRIS Berdasarkan Technology Acceptance Model. Nominal Barometer Riset Akuntansi Dan Manajemen, 12(1), 1–12. https://doi.org/10.21831/nominal.v12i1.52480

Sugiyanto, E. K., & Kurniasari, F. (2020). Dimensi Kualitas Pelayanan Sebagai Upaya Peningkatan Kepuasan Pelanggan (Studi Pada Pelanggan Hotel X Semarang). Business Management Analysis Journal (BMAJ), 3(2), 112–125. https://doi.org/10.24176/bmaj.v3i2.5372

Sugiyono. (2018). Metode Penelitian. Alfabeta.

Tague, N. R. (2023). The quality toolbox (Issue November). Quality Press.

Tedja, R.T.; Tjong, Y.; Deniswara, K. Factors Affecting the Behavioral Intention of E-Wallet Use during COVID-19 Pandemic in DKI Jakarta. In Proceedings of the 2021 International Conference on Information Management and Technology (ICIMTech), Jakarta, Indonesia, 14 September 2021.

Tham, K.W.; Dastane, O.; Johari, Z.; Ismail, N.B. Perceived Risk Factors Affecting Consumers’ Online Shopping Behaviour. J. Asian Financ. Econ. Bus. 2019, 6, 249–260.

Vatolkina, N., Gorbashko, E., Kamynina, N., & Fedotkina, O. (2020). E-service quality from attributes to outcomes: The similarity and difference between digital and hybrid services. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 1–21. https://doi.org/10.3390/joitmc6040143

Zhang, X.; Yu, X. The Impact of Perceived Risk on Consumers’ Cross-Platform Buying Behavior. Front. Psychol. 2020, 11, 592246.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Muhammad Fauzan Hartono, Nandang, Dimas Bagus Ramadhani, Indah Rosalia

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All articles published in the Journal Corner of Education, Linguistics, and Literature are licensed under the Creative Commons Attribution-ShareAlike License (CC BY-SA).